Vehicle insurance

Our insurance solution for your company vehicles

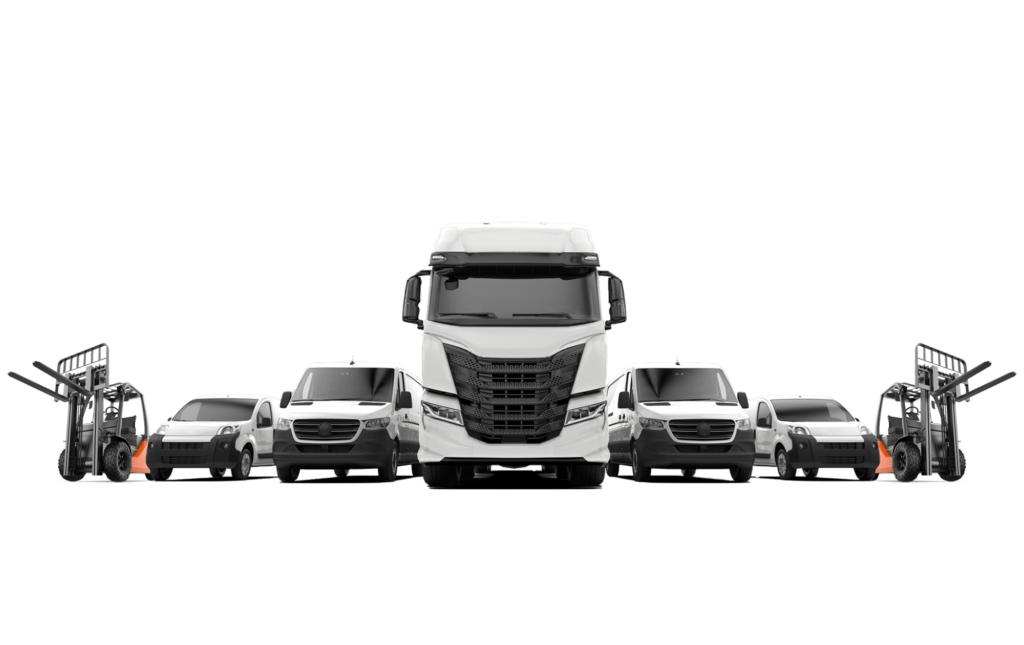

We offer tailor-made fleet insurance solutions for small and medium-sized businesses, whether they are engaged in public goods transport or own-account transport. Our offers are tailored to your needs and the specific risks associated with your activities, providing comprehensive, optimum protection for your business vehicles. Whether you have a single vehicle or several in your fleet, we offer solutions to suit the type of fleet you have.

Business vehicle insurance for transport professionals

(public goods transport)

At CSE Global, we offer high-performance, modular solutions that enable you to cover your liabilities effectively, protect your fleet of vehicles and your drivers, and thus guarantee the long-term future of your business.

We insure various types of vehicle, including:

- Heavy goods vehicles (trucks, tractors, trailers and semi-trailers).

- Company vehicles weighing less than 3.5 tonnes (vans, commercial vehicles and executive vehicles).

- Handling equipment used in the course of your professional activities.

Whatever type of vehicle you use in your business, we can provide you with the right insurance cover to meet your specific needs.

- Motor third-party liability

- Operating liability

- Vehicle damage (all-accident damage, theft, fire, vandalism, glass breakage, natural disasters, climatic events)

- Bodily injury to the driver

What’s more, we offer options to tailor cover to your company’s specific needs, such as financial loss, internal breakdown, driver and vehicle assistance, recovery costs, immobilisation package, replacement value, etc. So you can tailor your fleet insurance contract to your specific requirements.

For claims management, a team of transport insurance experts is available to provide you with the highest quality of service throughout the claims management process.

Insurance for your company vehicles

(own account transport)

Would you like to insure your fleet against accidents involving your company vehicles, against possible theft of professional equipment from your commercial vehicles, in the event of breakdown of handling equipment, …

At CSE Global, we understand that each company is unique, which is why we work closely with you to define personalized cover, adapted to the type of fleet you have, the specific features of your business and your real needs, in order to optimise the cover for your company vehicles.

We insure various types of vehicle, including:

Heavy goods vehicles such as trucks, tractors, trailers and semi-trailers.

Company vehicles weighing less than 3.5 tonnes (utility, commercial and executive vehicles)

2-wheelers

Handling equipment and site machinery

- Motor third-party liability

- Operating liability

- Vehicle damage (all-accident damage, theft, fire, vandalism, glass breakage, natural disasters, climatic events)

- Machinery breakdown

- Goods and equipment transported

- Personal injury to the driver

- Assistance

- …

In the event of an incident such as an accident, theft or breakdown, our specialist team will be with you every step of the way, from taking charge of your vehicle, including breakdown recovery and towing if necessary, to activating the assistance service to offer you solutions such as repatriation, onward travel or accommodation.

Contact us

"*" indicates required fields